SUI slips after 34% surge – All eyes on THIS support next

- topcryptonews

- Jul 20, 2025

- 2 min read

SUI surged 34% but now faces short-term selling pressure. Traders lean bearish, yet $50 million in exchange outflows suggest long-term accumulation and potential for a rebound above $4.20.

After a notable 34% monthly price surge, Sui (SUI) is experiencing short-term selling pressure and appears to be poised for a potential price drop.

Sui rallied strongly over the past week, breaking out of a descending trendline and reaching the key $4.20 level.

However, after failing to hold its recent consolidation, the price action now signals a potential correction or downside move.

Current price momentum

At press time, following a 7.50% price dip over the past 24 hours, SUI was hovering near the $3.77 level.

However, traders and investors have pulled back, leading to a 26% drop in SUI’s trading volume over the past 24 hours.

This decline likely stems from profit-taking after a sharp 34% price rally, with capital possibly rotating into ecosystem-driven assets like Ripple [XRP] and Avalanche [AVAX].

Sui price action and key levels

SUI has turned bearish in the short term following the breakdown of price consolidation near the $4.20 level.

If SUI’s current momentum and market sentiment persist, the price could dip 10%, potentially reaching support at $3.40 in the coming days.

Conversely, $4.20 remains a key breakout level. If SUI closes a daily candle above $4.20, it could rally 30% and target $5.50. This bullish scenario is only valid with a confirmed close above $4.20—otherwise, it’s invalidated.

At the time of writing, SUI’s RSI cooled to 61, down from overbought levels, signaling waning bullish momentum and a possible short-term consolidation or correction.

SUI’s on-chain metric shared mixed sentiment

Data shows that SUI’s current long/short ratio stands at 0.87, indicating strong bearish sentiment among traders.

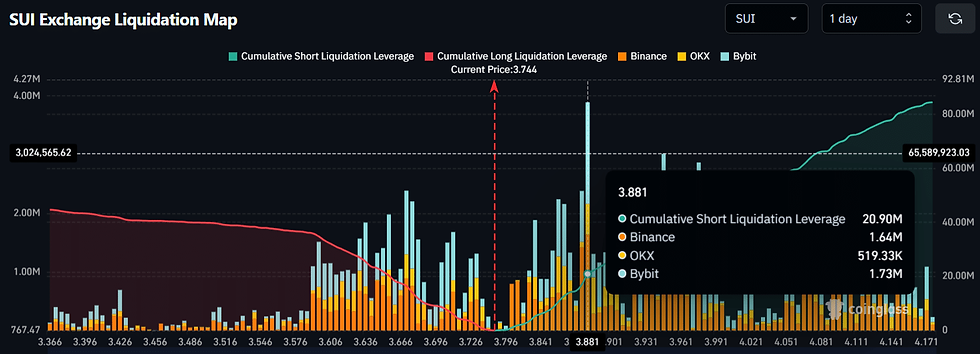

Meanwhile, the major liquidation levels where traders have shown interest are $3.67 on the lower side and $3.88 on the upper side.

Around $14.44 million worth of long positions and $20.90 million worth of short positions have been recorded at these levels. This clearly reflects traders’ sentiment amid the ongoing correction.

However, investors and long-term holders have taken advantage of this price dip by accumulating more SUI.

Data from Coinglass reveals that nearly $50 million worth of SUI has left exchanges. This indicates potential accumulation and signaling strong long-term potential.