Why Ethena [ENA] can reach $0.88 soon, if not $1

- topcryptonews

- Sep 4, 2025

- 2 min read

Ethena [ENA] has continued to maintain its bullish momentum, recording four straight weeks of inflows amounting to a 15% increase.

Several indicators and found that investors have increasingly started to view ENA as an undervalued asset, with liquidity inflows continuing to strengthen.

ENA earnings rebound

Ethena Labs’ latest earnings data, tracked by DeFiLlama, showed a sharp increase, reaching a new peak of $7.43 million.

This marked its highest level to date, following a weaker second quarter where earnings fell to $1.15 million from $7.92 million.

The notable rebound reflects stronger revenue, particularly as Ethena’s synthetic dollar utility gains more traction. Investors have been paying close attention, with some actively rotating capital into ENA.

On-chain data showed that one investor recently sold a major PEPE position to acquire $1.29 million worth of ENA, bringing their total holdings to $10 million.

CoinMarketCap data provided further insight, revealing that the number of ENA holders has climbed to a record 76,440. The asset’s market capitalization grew as well, reaching $4.33 billion.

Long-term outlook strengthens

The broader outlook for ENA continues to lean long-term, supported by both spot and on-chain activity.

Over the past two weeks, spot investors have stepped up their purchases, with total accumulation exceeding $50 million.

CoinGlass Spot Exchange Netflow shows that most of this purchased ENA has been moved into private wallets, reflecting a strong long-term holding sentiment.

In fact, this accumulation trend has persisted on a weekly basis since the 11th of August.

On-chain activity echoes this same long-term conviction.

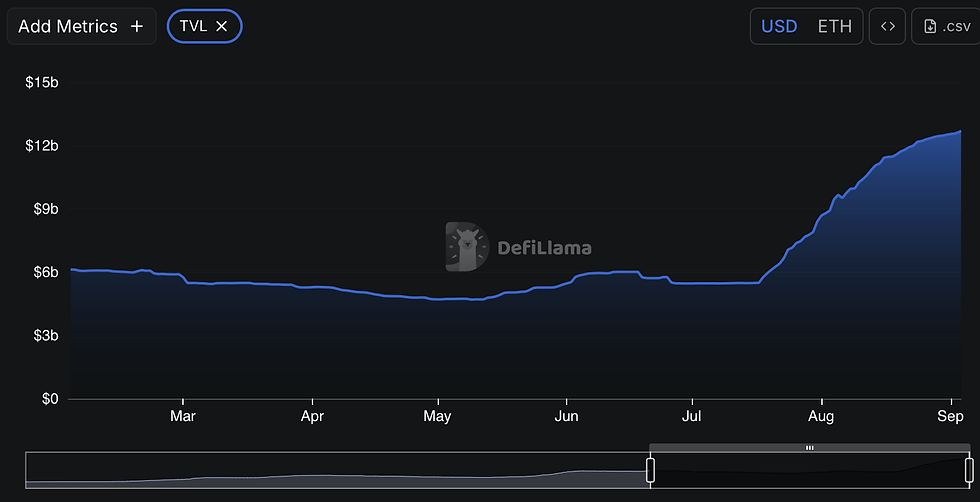

TVL, which measures the total ENA deposited and locked in the protocol, has climbed to a record $12.66 billion, according to DeFiLlama.

Thus, more investors are committing capital, and the flow of liquidity into the market is likely to continue.

Bullish bias intensifies

AMBCrypto’s analysis found that ENA has maintained an overall bullish stance in the market, with the asset forming what appears to be a bullish flag pattern.

At the time of writing, ENA appeared to have broken out of its most recent consolidation channel and looked poised to rally to at least $0.88, with a possible extension toward $1.

If liquidity inflows continue to intensify, ENA may replicate past upward moves—an outlook already visible in current chart formations.